If you only sell on credit you won’t need to adjust your sales totals, but if you have cash sales as well, you will want to make an adjustment to your sales number before using it in your equation.įor instance, let’s use the following calculation to determine your net credit sales. Your income statement for the year will provide you with net sales for your business. You can get this number from your income statement or profit and loss statement. Your first step to calculating your accounts receivable turnover is to obtain your net sales for the year.

#AR TURNOVER HOW TO#

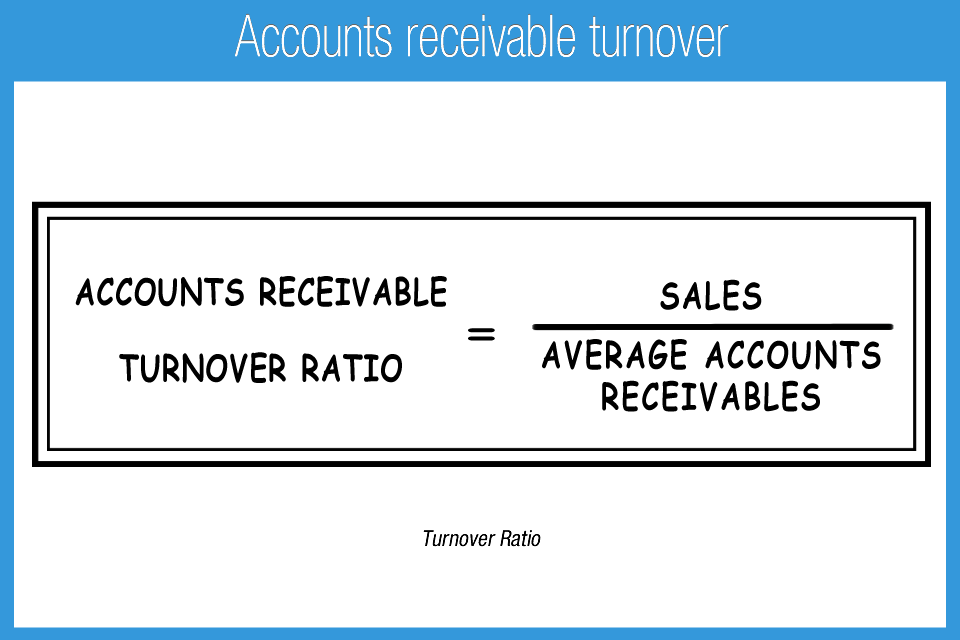

How to calculate accounts receivable turnoverįollow along as we give you step-by-step instructions on how to calculate your accounts receivable turnover ratio. The accounts receivable turnover formula is easy to understand, even for small business owners without an accounting background, and all you’ll need is access to your financial statements to calculate your own ratio. Particularly useful when preparing financial projections, knowing your accounts receivable turnover ratio can give you greater insights into your business operations, allowing you to analyze and alter processes if necessary. Your staff bookkeeper or accountant or you can easily calculate your accounts receivable turnover using a simple formula which we will provide you along with tips on what the results mean. Calculating your accounts receivable turnover ratio helps you measure how effectively you manage your credit customers, and more importantly, how quickly you collect on their balances due. If you’re familiar with bookkeeping basics and double-entry accounting, you know that accounts receivable is part of the accounting cycle.

Overview: What is accounts receivable turnover? Read on as we provide you with easy steps and a formula for calculating your accounts receivable turnover ratio.

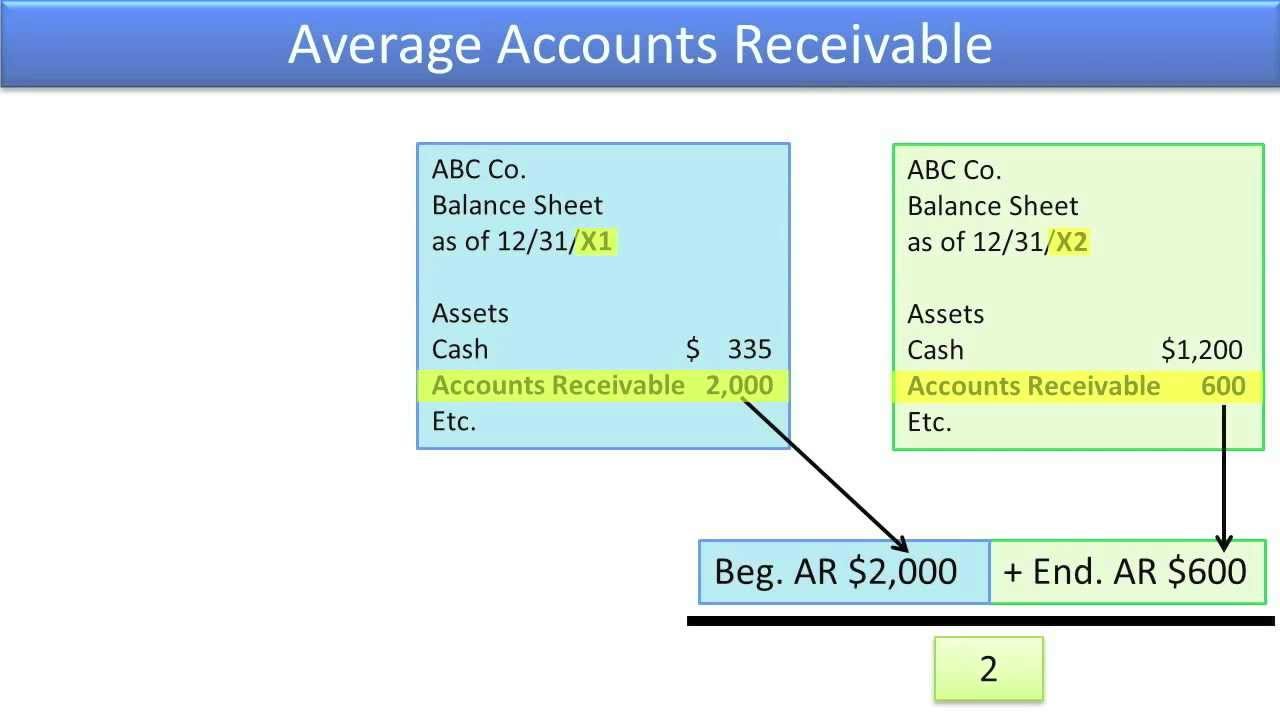

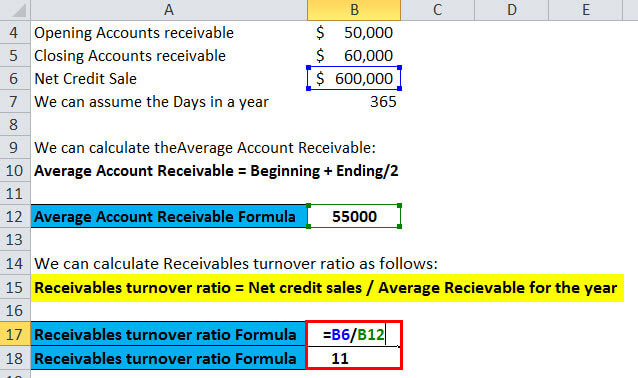

While it may sound complicated, calculating your accounts receivable turnover ratio is a lot easier than you may think. Based on these numbers, Corporation B has the strongest collections.There are many accounting ratios that can be particularly helpful for your small business, but for those offering credit terms to their customers, none is as useful as the accounts receivable turnover ratio. Company C, its biggest competitor has an accounts receivable turnover of 21, while Corporation B has an accounts receivable turnover of 10. Accounts receivable turnover exampleĬorporation A has a beginning accounts receivable of $125,000 and an ending accounts receivable of $235,000 and a net credit sales of $2.8 million, the formula would look like this: Step 2: Net credit sales / accounts receivable = accounts receivable turnoverĭo you owe on unpaid credit? Consider a balance-transfer credit card to help manage your debt.Step 1: Beginning accounts receivable + ending accounts receivable / 2 = net accounts receivable.Take that figure and divide it into the net credit sales for the year for the average accounts receivable turnover. To calculate the accounts receivable turnover, start by adding the beginning and ending accounts receivable and divide it by 2 to calculate the average accounts receivable for the period. This ratio gives the business a solid idea of how efficiently it collects on debts owed toward credit it extended, with a lower number showing higher efficiency. Deeper definitionĪccounts receivable turnover is described as a ratio of average accounts receivable for a period divided by the net credit sales for that same period. Accountants and analysts use accounts receivable turnover to measure how efficiently companies collect on the credit that they provide their customers. What to do when you lose your 401(k) matchĪccounts receivable turnover is the number of times per year that a business collects its average accounts receivable. Should you accept an early retirement offer?

How much should you contribute to your 401(k)?

0 kommentar(er)

0 kommentar(er)